In order to derive the utmost benefit from the sacred month of Ramadān, it is crucial to recognize the spiritual significance and import of this month. Abdullah ibn Mas‘ūd radiallahu anhu states, “The master of months is the month of Ramadān and the master of days is the day of Jumu‘ah.” Ramadān is the month, after a year full of sin and spiritual retrogression, which Allah Ta’ala has designated for the revivification of the soul and one’s spiritual ascension. Ramadān is the month, after drifting away from Allah, wherein a servant once again is able to draw near to his Cherisher. However, all this will only be possible is we value this precious month and prepare for it accordingly. (more…)

21 Common Misconceptions about Zakaah

by Asma bint Shameem

Misconception # 1

I pray, dont I?

Whats the big deal if I dont give Zakaah?

Zakaah is one of the PILLARS of Islam and NOT an option. It is just as important to ones faith as Salaah. In fact, anyone who denies it is a Kaafir and the Prophet (pbuh) and his Sahaba waged war against such persons even though they uttered the Shahadah and prayed Salaah.

About such people Abu Bakr said: “By God! I shall certainly wage war against the people who discriminate between Salaah and Zakaah.” (Bukhaari, Muslim)

Misconception # 2:

But it will decrease my wealth!

Abu Hurayra said that the Prophet (pbuh) said,

“Whoever is given wealth by Allaah and does not pay the Zakaah due thereupon shall find that on the Day of Arising it is made to appear to him as a hairless snake with two black specks, which chains him, and then seizes him by his jaw and says, -I am your wealth! I am your treasure!’

Then he recited the verse, Let not those who are miserly with what God has given them of His bounty think that this is good for them. Rather, it is bad for them. That which they withhold shall be hung around their necks on the Day of Arising. [3:180] (Bukhaari)

Misconception #3:

I dont have to pay Zakaah every year.

Zakaah is an obligation that must be paid each year. The Prophet (pbuh) used to send the zakaah-collectors to the tribes and cities, and they did not differentiate between those who had paid their zakaah the previous year and those who had not, rather they used to take the zakaah that was due on all the “zakaatable” wealth that people possessed.

Misconception # 4:

I never paid Zakaah before.

I will just repent and that should be enough

The one who never paid Zakaah before should repent to Allaah first. Then he should estimate the amount of Zakaah that was due on him over the years as best he can, and pay it as soon as possible

Misconception # 5:

I dont have to pay Zakaah if I owe a debt

The one who has any “zakatable” wealth must pay zakaah on it, when one year has passed since he acquired it, even if he has debts, according to the more correct of the two scholarly opinions. The Prophet (pbuh) used to command his agents to take zakaah from those who owed zakaah, and he did not tell them to ask them whether they had any debts or not. (Majmoo Fataawa -Abd al-Azeez ibn Baaz)

Misconception # 6:

I will waive my debt and count that as Zakaah

The Prophet (pbuh) said to Muaadh ibn Jabal, when he sent him to Yemen: “Teach them that Allaah has enjoined upon them zakaah on their wealth, to be taken from their rich and given to their poor.”

He (pbuh) explained that zakaah is something which is to be taken and given, so on this basis it is not permissible to let off someone who owes you money and count that as zakaah, because letting someone off a debt does not involve taking and giving.

(Fataawa Manaar al-Islam by Shaykh Ibn Uthaymeen)

Shaykh al-Islam said: “letting someone off a debt does not relieve one of the obligation of zakaah, and there is no scholarly dispute on this matter. But you can give this needy person some of your zakaah and he can meet his needs using what you give him as zakaah; and Allaah will help him to pay off his debt in the future, inshaAllaah.”

Misconception #7:

I have lent someone some money. I dont have to pay Zakaah on it.

In this situation, there can be two scenarios;

1. If the borrower is rich and is known to repay debts promptly: The lender has to pay Zakaah annually on the money lent, because it is possible to recover the money readily and it is like money that is in ones possession.

2. If it is unlikely that the lender will get his money back or the borrower is known to delay repayment: Then the lender does not have to pay zakaah before he gets the money back, because it is not readily accessible and is not like money that is in ones possession.

Misconception # 8:

I pay my taxes so I dont have to pay Zakaah!

The taxes we pay are to Uncle Sam/govt , not to Allaah to Whom the Zakaah is due. And this Zakaah money is to be only spent according to the rules of Shareeah in certain specific ways. Thus, it is not permissible for the taxes we pay on our wealth to be counted as part of Zakaah. The obligatory Zakaah must be paid separately.

Misconception # 9:

I will use the money that I receive from my bank as interest to pay off Zakaah

First of all, putting money in the bank in return for interest is a kind of riba which Allaah and His Messenger have forbidden, and it is a major sin. The Prophet(pbuh) cursed the one who consumes riba and the one who pays it. (Muslim)

This money cannot be used to pay Zakaah or other kinds of charity since it is impure and a haraam form of wealth.

Misconception # 10:

I will pay Zakaah on whatever is OVER the Nisaab

If ones wealth surpasses the amount of nisaab, then Zakaah is due upon it ALL, and not upon the surplus only.

Misconception #11:

Zakaah is due on precious gems, stones and diamonds

No zakaah is due on gems, precious stones, diamonds, etc. unless they are prepared for trade, in which case they come under the same ruling as all other trade goods

Misconception # 12:

I will buy diamonds so that I dont have to pay Zakaah

Some people try to get out of Zakaah by investing in diamonds, since no Zakaah is due on them, and think they can outsmart Allah.

Doesnt Allaah know whats in our hearts and minds?

They forget that Zakaah is due on them if they are prepared for trade. “They seek to deceive Allah and those who believe, but they deceive none except themselves, though they do not sense it.“ (Surah al-Baqarah: 9)

Misconception # 13:

The husband HAS to pay Zakaah on the wifes jewelry and wealth

It is NOT the husbands duty to pay Zakaah on his wifes jewelry, wealth, etc. Rather, it is her responsibility, since she is the possessor of the wealth. If her husband or someone else pays zakaah on her behalf with her permission, that is o.k., and he will be rewarded for this voluntary action.

Misconception # 14:

I only have gold, but I do not have any money. So, I dont have to pay Zakaah….

Shaykh Ibn Uthaymeen said:“ Zakaah must be paid on jewelry if it reaches the nisaab (minimum threshold), which is 85 grams. If it reaches this amount, zakaah must be paid on it. If she has other wealth and pays from that, there is nothing wrong with it. If her husband or one of her relatives pays it on her behalf, there is nothing wrong with that. If neither of these options is available to her, then she should sell some of it and pay zakaah with that money.”

Misconception # 15:

I will use my Zakaah money on my immediate family

Shaykh Ibn Baaz said: “The Muslim cannot give his zakaah to his parents or to his wife and children; rather he is obliged to spend on them from his wealth if they need that and he is able to spend on them.”

Misconception # 16:

I cannot give Zakaah to my poor relatives

It is actually preferable for a person to give their zakaah to a brother, sister, paternal uncle, paternal aunt or to any other relative, if they are poor. This is because, giving zakaah to them is both an act of charity and upholding family ties.

The Prophet (pbuh) said: “Charity given to the poor is charity and charity given to a relative is charity and upholding of family ties.” (Ahmad, al-Nasaa’i)

Misconception # 17:

A woman cannot give Zakaah to her Husband

It is okay for a woman to give zakaah to her husband, if he is qualified to receive zakaah, because she is not obliged to spend on him. Also, the Prophet (pbuh) gave permission to the wife of Abd-Allaah ibn Masood to give her zakaah to her husband

Misconception # 18:

Zakaah can be given to Non-Muslims if they are poor

It is not permissible to give Zakaah to any kaafir except the one who is inclined towards Islam, in the hope that he will become Muslim if you give him zakaah (al-Tawbah:60).

Misconception # 19:

I will use Zakaah to build hospitals, masjid and orphanages

That is not permissible, because this is not included in the eight categories on which zakaah may be spent.

Allaah tells us that Zakaah may be spent on the following:

“As-Sadaqaat (Zakaah) are only

for the Fuqaraa (poor),

and Al-Masaakeen (the poor)

and those employed to collect (the funds);

and to attract the hearts of those who have been inclined (towards Islam);

and to free the captives;

and for those in debt;

and for Allaah’s Cause (Mujaahidoon — those fighting in a holy battle),

and for the wayfarer (a traveler who is cut off from everything)” [al-Tawbah:60]

But if the intention in giving the money to an orphanage is so that this money will be spent on the poor orphans, then this is permissible, if the orphans are poor.

Similarly, Zakaah cannot be used to print Quraans and other Dawah material.

Misconception # 20:

Zakaah is the same as Zakaat ul-Fitr

Zakaat al-Fitr is NOT the same as Zakaah. These are two separate entities and whoever paid Zakaah is NOT relieved of paying Zakaat al-Fitr and vice-versa.

Misconception # 21:

I have to inform the one I am giving, that it is Zakaah

You do not have to tell the recipient that it is zakaah.

Must watch…

Is giving Charity (zakat) to Sayyid (Syed) forbidden (HARAM) in Islam?

Islam the solution for poverty

What amount should be given in Sadaqah (voluntary charity)?

Source:sunniforum

Ramadan & Laila-tul-Qadar – The Core of Holy month

Ramadan comprised of 29 or 30 days is the ninth month according to the Islamic lunar calendar. Muslims have been ordered to fast for the sake of Allah during the Holy month of Ramadan. It is obligatory for them to do fasting. The fast begins early in the morning at dawn and the fast breaks at the dusk or in the evening. Muslims observe the fasting and offer more prayers than usual. They are encouraged to recite Holly Quran during the day and at night during Traweeh and Isha prayer. They visit the mosques every night throughout the month to gain blessings of Allah Subhana wa Tallah. They perform supplication, invocation and some of the Muslims go for eitakaaf. (more…)

Sa’d ibn Abī Waqqās (RA) was one of the ten people who were promised paradise by the Holy Prophet Muhammad (SAW). He (RA) was in the panel of the six people who had to choose the next caliph of Islam among them after the death of the second caliph Hazrat Umar (RA). He (RA) served his whole life in serving Islam and spreading it. He (RA) took many responsibilities at the advent of Islam.

He (RA) embraced the teachings of Islam at a young age of 17 and was one of the earliest to do it. Sa’d ibn Abī Waqqās (RA) was closely related to the Holy Prophet (SAW) and was his (SAW) cousin. However, Holy Prophet (SAW) considered him his uncle. Holy Prophet (SAW) once said: “Here is my uncle, Sa`d. if anyone has an uncle like him, then he should show me.” [Ibn Hajari, Tarikh, 2:33; Ibn Athir, ibid, 2:291]. Sa’d ibn Abī Waqqās (RA) was one of those sahabas or companion of Rasool Allah who worked tirelessly for the betterment of Islam and he (RA) also took the responsibilities of preacher, ambassador and an adviser to the Holy Prophet (SAW). He (RA) played a vital role in the battles of Persia and Qadsiya in the reign of Hazrat Umar (RA). He (RA) was sent to the battlefield as commander of the army in both these conquests. With his immaculate strength and bravery, he (RA) taught a worthy lesson to the enemies of Islam.

| Sa`D Ibn Abi Waqas (RA) Biography In Brief | |

|---|---|

| 595 – 674 | |

| Place of birth | Mecca, Arabia |

| Place of death | Madinah, Arabia. |

| Allegiance | Rashidun Caliphate. |

| Service/branch | Rashidun army |

| Years of service | 636-644 |

| Rank | Commander Governor of Ctesiphon (637-638) Governor of Busra (638-644), (645-646) |

| Commands held | Rashidun conquest of Persian Empire |

The Memorable Role

Sa’d ibn Abī Waqqās (RA) was a preacher and played a role of advisor to Rasool Allah. He was a traveler and famous warrior. Designated as ambassador he (RA) played a significant role in developing the diplomatic relations with China. At the age of eighty he died and is buried in Madinah. The immaculate and impeccable services by Sa’d ibn Abī Waqqās would always be remembered as he was loyal to the Holy Prophet (SAW). His statesmanship and Governorship of Persia are notable services to Islam.

Assalāmu `alaikum Warahmatullāhi Wabrakatuh,

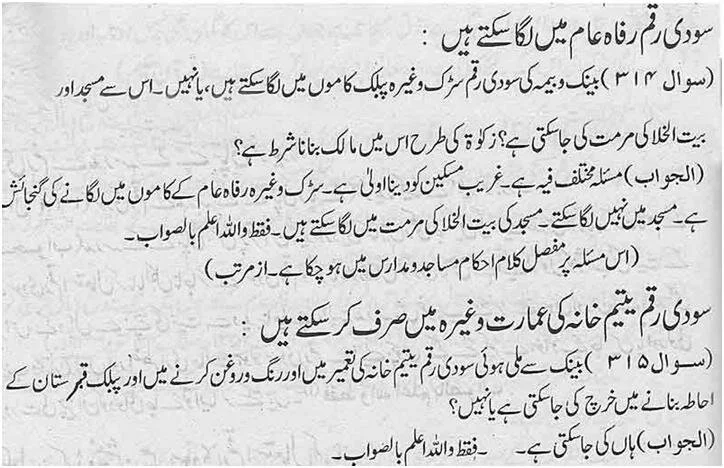

There are two views among the Ulama regarding the disposal of interest money received from the bank:

1) The first view is that such interest money can only be given to the poor who are entitled to receive Zakat (i.e. they must not possess the nisab of Zakat). It is also necessary that the recipients are granted ownership and possession of the wealth (tamleek al-fuqaraa). According to this view, it is not permissible to utilise such interest money directly in public welfare projects, such as building roads, bridges and public toilets etc.

(Fatawa Mahmudiya: 24l431, Maktaba Mahmudiya)

2) The second view is that in addition to giving such interest money to the poor, it is permissible to use such interest money directly in public welfare projects. According to this view, granting of ownership to the poor (tamleek al-fuqaraa) is not a requirement.

(Fatawa Raheemiya: 9/279-282, Darul Isha’at)*

(Kifayatul Mufti: 7/105, Darul Isha’at)

The first view is more precautionary (ahwat) whereas the second view is more accommodating (awsa’).

In view of the different academic views, there is a leeway to use interest money received from the bank for the construction of toilets and ablution facility for an orphanage.

Note:

As a general rule, no Muslim by his free choice should deposit his money in an interest-bearing account. A non interest-bearing account should be utilised for the purpose. If there are any intricacies, a mufti should be consulted.

And Allah Ta’āla Knows Best

Maulana Faizal Riza

Student, Darul Iftaa

Australia

Checked and Approved by,

Muftī Ebrahim Desai.

Ramadan is the only holy month in which Muslims from all over the world go for the fasting to please their Allah Subhana Wa Tallah. It is necessary for them from not only Islamic point of view, but also it is important for the maintenance and growth of their physical health. Fasting in Ramadan is an effective treatment for both emotional and psychological illnesses.

Fasting is not simply the orderly skipping of harmful meals but it is helpful to boost the person’s will power, improve his taste and manners, reinforce his beliefs, encourages doing well and avoiding of sins. It also strengthens the faith of a believer and the person during the fasting has to avoid disagreement, sulkiness, rashness and all that does not contribute towards a well-balanced and healthy personality.

Besides nutrition, the resistance and ability to face hardships and endurance develops and enhances. Fasting reflects on external physical appearance by eliminating greediness and getting rid of negative thoughts. There are number of benefits of fasting on health, which are instrumental in alleviating a number of physical diseases, such poor digestive system, chronic stomachache, indigestion and so on. Obesity, high blood pressure and other threatening maladies can also be cured with the help of fasting in Ramadan. Scientists and physicians have suggested that fasting should be regarded as an effective means of restoring youthfulness and longevity. However, Islam exempts the sick and old from fasting.

In order to take full benefit of fasting and improve your general health in Ramadan you must follow some rules and regulations improvised by Islam. You can have a good Sehari and eat sensibly at iftar. Do not eat too much fried or spicy products to avoid the fat building and drink lots fluids for the detoxification process of your body during Seher and Iftar.